AI Solutions for Finance

Enhance decision-making, improve customer experiences, and streamline operations in the financial sector

Book a Consultation

Artificial Intelligence (AI) is transforming the financial sector by enhancing decision-making, improving customer experiences, and streamlining operations. At Digital Deep, we provide specialized AI consultancy services tailored for financial institutions, helping you leverage the power of AI to stay competitive in a rapidly evolving market.

Our finance-focused solutions address the unique challenges and opportunities in the financial sector, ensuring compliance with regulations while driving innovation and efficiency. We work closely with financial institutions to identify the most impactful AI applications and guide them through successful implementation.

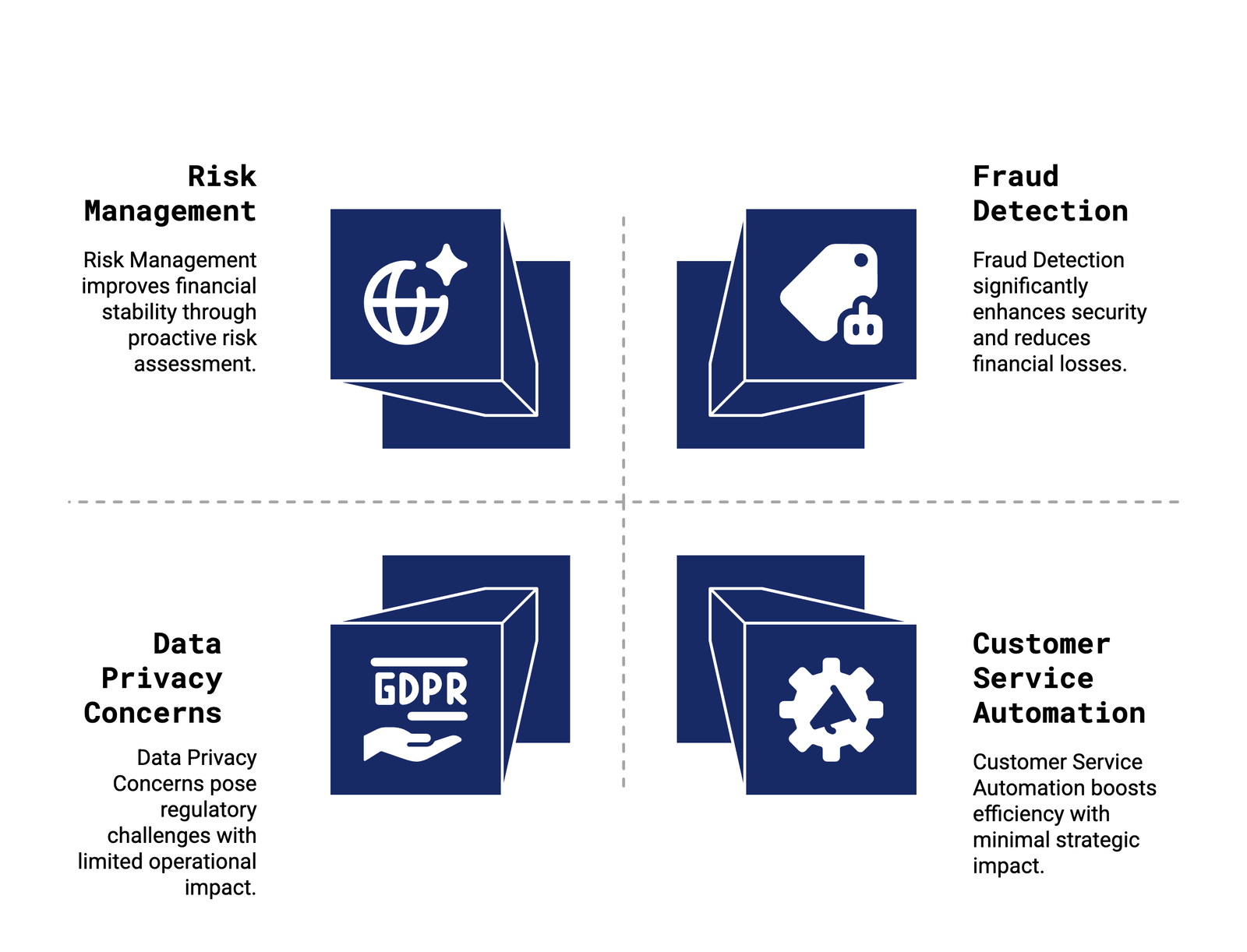

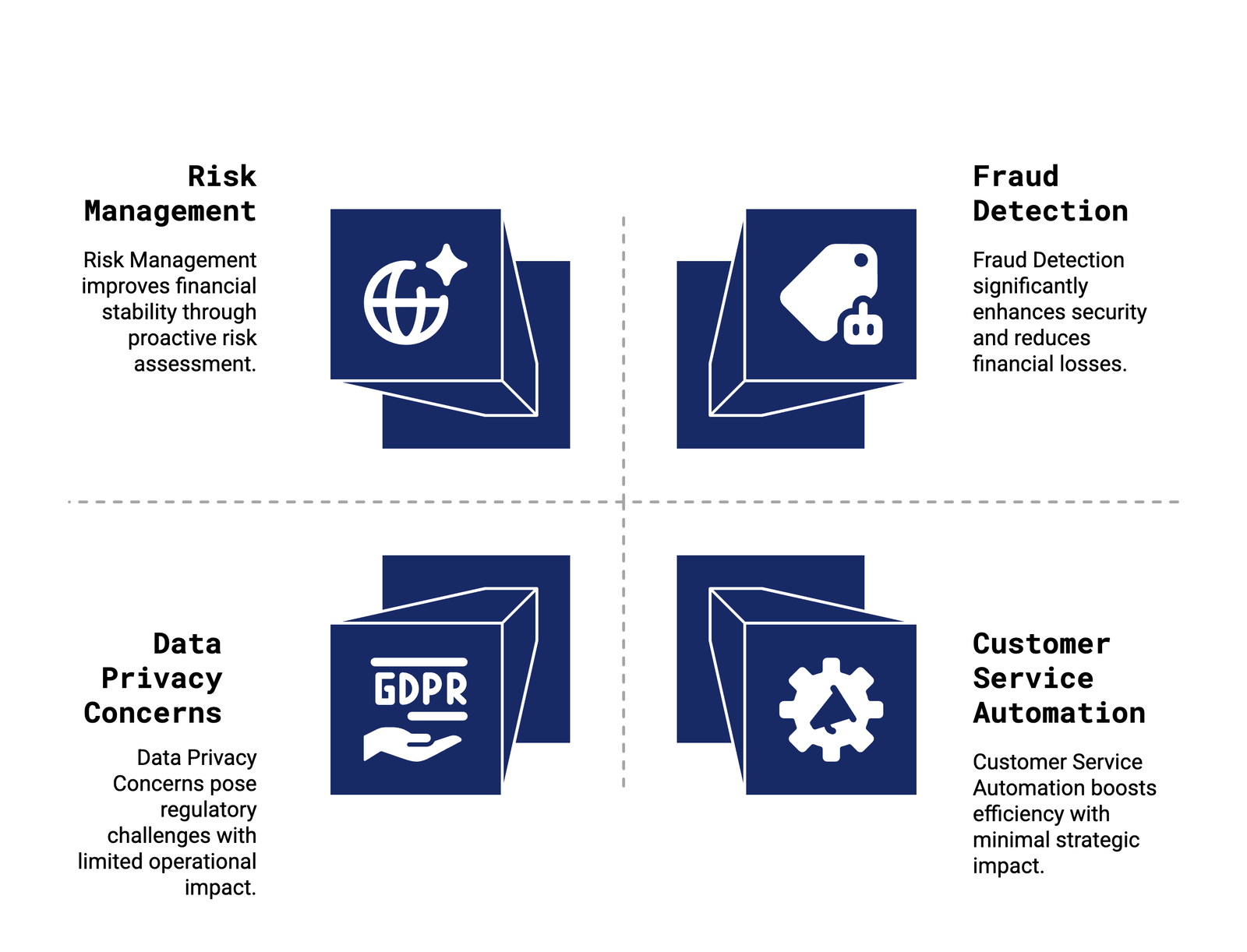

Risk Management improves financial stability through proactive risk assessment. Our AI solutions analyze vast amounts of data to identify potential risks and predict market fluctuations. By employing machine learning algorithms, we help financial institutions enhance their risk assessment processes and develop more robust risk mitigation strategies.

Fraud Detection significantly enhances security and reduces financial losses. Our AI-driven systems detect unusual patterns and anomalies in transaction data, significantly reducing the incidence of fraud. These systems learn from historical data to improve their accuracy over time, providing a proactive approach to fraud prevention.

Customer Service Automation boosts efficiency with minimal strategic impact. Our AI chatbots and virtual assistants are revolutionizing customer service in finance. They provide 24/7 support, handle inquiries efficiently, and can personalize interactions based on customer data, leading to improved customer satisfaction.

Our AI can analyze market trends and historical data to inform investment decisions. By leveraging predictive analytics, we help financial institutions optimize their portfolios and enhance their trading strategies, providing a competitive edge in the market.

Our AI tools assist in monitoring compliance with financial regulations by automating reporting processes and ensuring that institutions adhere to legal requirements, thereby reducing the risk of penalties and maintaining trust with regulators and customers.

Data Privacy Concerns pose regulatory challenges with limited operational impact. We help financial institutions navigate complex regulations regarding data privacy and ensure that AI systems comply with these laws. Our approach prioritizes data security and customer privacy.

Many financial institutions operate on outdated systems, making it challenging to integrate new AI technologies. Our expertise in system integration ensures a smooth transition, minimizing disruption to your operations while maximizing the benefits of AI.

There is often a lack of skilled professionals who can effectively implement and manage AI solutions in finance. Our consultancy services bridge this gap, providing both the expertise needed for implementation and the training required for your team to maintain and leverage these systems.

AI systems can inadvertently perpetuate biases present in the training data, leading to unfair outcomes. We implement rigorous testing and validation processes to identify and mitigate bias in AI models, ensuring fair and ethical use of AI in financial services.

At Digital Deep, we understand the unique challenges and opportunities in the financial sector. Our approach includes:

Our team of experts is ready to help you implement cutting-edge AI solutions tailored to your specific needs in the financial sector. Schedule a consultation today to learn how we can help you enhance decision-making, improve customer experiences, and streamline operations.

Book Your Consultation